delayed draw term loan accounting

However they can also be attached to unitranche financing. The DDTL typically has specific time periods such as three six or time months for.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Some key Limitations of a Term Loan.

. Key Takeaways A delayed draw term loan DDTL allows you to withdraw funds from one loan amount several times through predetermined. Borrowers need fixed assets with higher market value to pledge as collateral. Delayed Draw Term Loan Availability Period means the period from and including the Closing Date and ending on the earliest of the following.

The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first borrowing of Delayed Draw Term Loans on the last day of each March June September and December each in an amount equal to one and one-quarter percent 125 of the aggregate. Or in the case of payments to the Administrative Agent as determined by the Administrative Agent as follows. TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60 million available for a commitment period of five years from the closing date and a 100 million DDTL facility available to draw for two years from the closing date.

Fast forward to today. DDTLs are usually used by businesses that would like to purchase capital refinance debt or make acquisitions. While you may enjoy the flexibility and save money on.

Subject to the terms and conditions set forth herein each Lender severally agrees to make term loans each a Loan and collectively the Loans in Dollars to the Borrower at any time and from time to time during the Availability Period but in any event except with respect to Mandatory Borrowings on no more than two occasions in an amount not to exceed the. A Upon the terms and conditions set forth in this Agreement and in reliance upon the representations and warranties of the Borrower herein set forth the Lender agrees to make a a Loan to the Borrower on the Closing Date in the principal amount of 16295500 and b a Loan to the Borrower after the Closing Date and prior to the Commitment Termination Date in a. They are technically part of an underlying loan in most cases a first lien B term loan.

I the first day on which the aggregate amount of the Delayed Draw Term Loans advanced hereunder is equal to 25000000 ii the date that is the eighteen 18 month anniversary of the Closing Date and such earlier date on which the. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional debt. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan term and fronting arrangements in.

3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10 test since the commitment is not funded on the modification date. Term loans are long-term financing solutions for fixed asset purchases and long-term projects. Prior to the COVID 19 pandemic a borrower could use a DDTL for a reason as undefined as an investment or general business purpose corresponding to the placement of cash on a companys balance.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Ii second to any other Lender which has made a Covering Advance to fund the Defaulting Lenders share of any Advance which the Defaulting Lender has. This CLE course will discuss the terms and structuring of delayed draw term loans.

A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives. The late draw is ideal for sponsors whose investment work includes a series of complementary acquisitions which is almost all in the current climate. I first to the payment of any amounts owing by such Defaulting Lender to the Administrative Agent hereunder.

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified time period ie the reporting entity gets to choose the date that the debt funds within a. What are Delayed Draw Term Loans.

Term loans come with consistency and stability that can help borrowers in financial forecasting.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Financing Fees Deferred Capitalized Amortized

Financing Fees Deferred Capitalized Amortized

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Advice Finance Saving

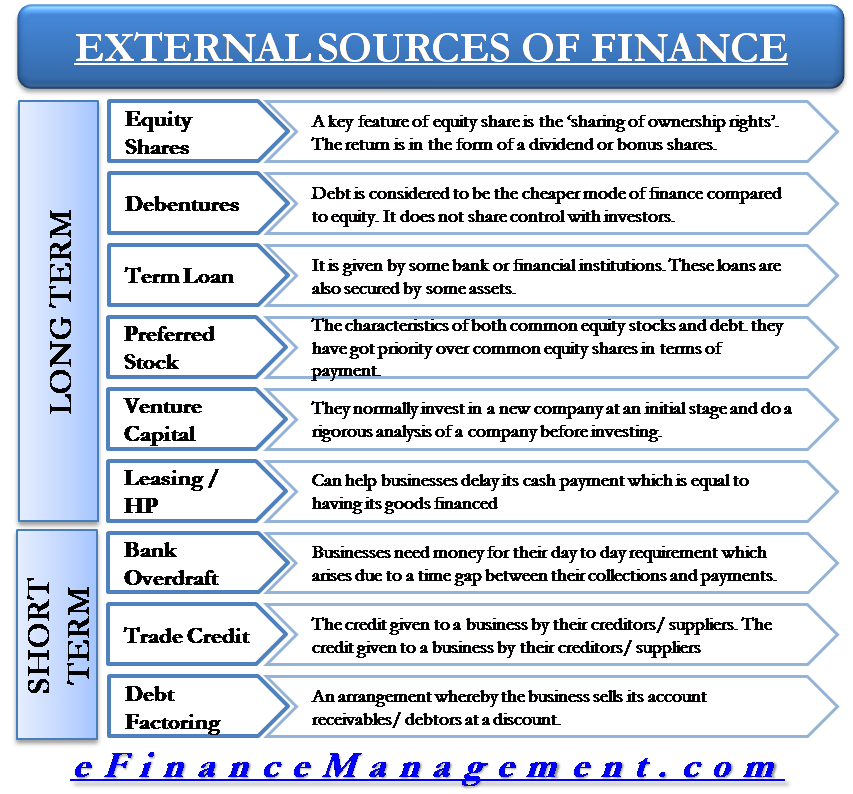

External Sources Of Finance Capital

Financing Fees Deferred Capitalized Amortized

Balance Sheet Long Term Liabilities Accountingcoach

7 3 Classification Of Preferred Stock

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

Delayed Draw Term Loan Ddtl Overview Structure Benefits

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Understanding The Construction Draw Schedule Propertymetrics

Delayed Draw Term Loans Financial Edge

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Comments

Post a Comment